Integrations See all integrations

Why you’ll love BevSpot

70% reduction

in time spent on inventory on average

50% less

sitting inventory reported on average

1 place

to manage multiple locations

What you can do with BevSpot See how it works

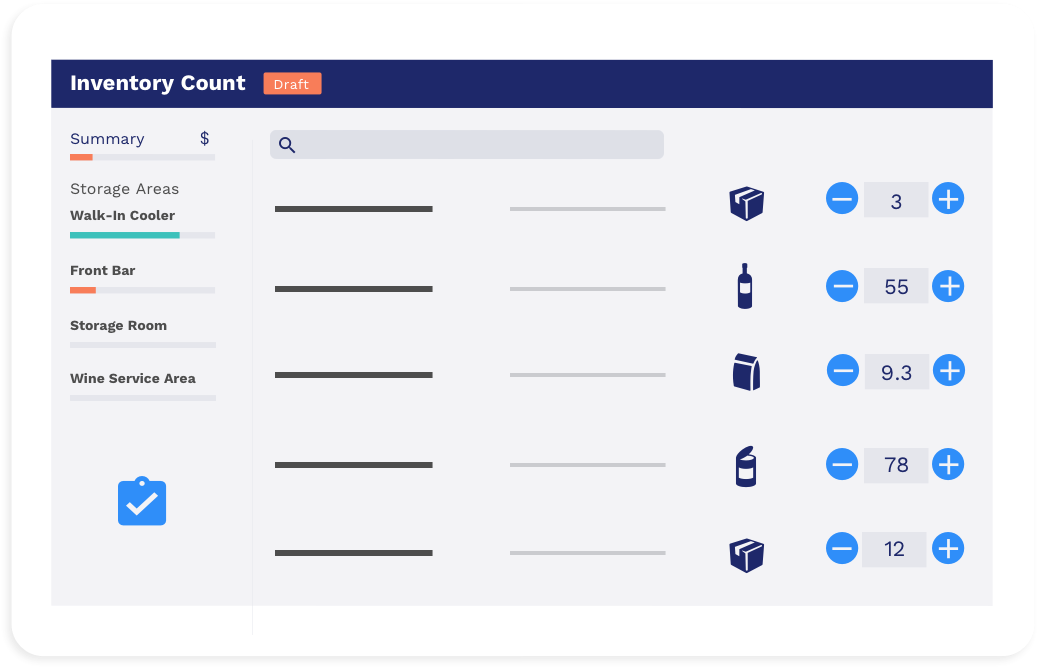

Take inventory any time, any where.

Take inventory faster than ever with shelf to sheet sorting, custom storage areas, offline mode and more.

Learn more about inventory

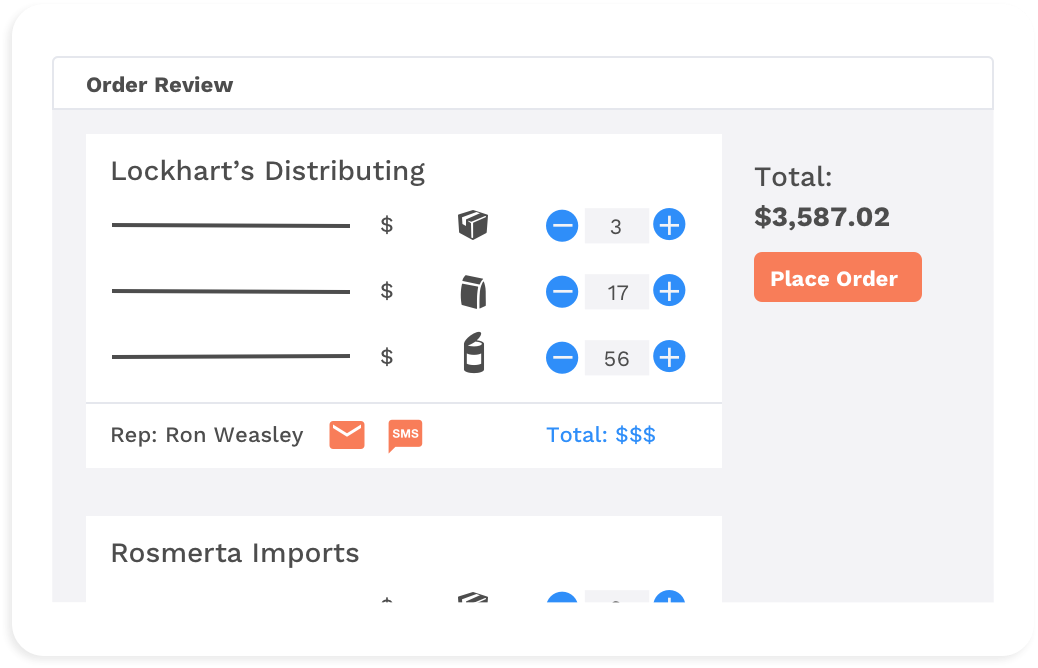

Order confidently in just one click, no matter where you are.

Order from your vendors right in BevSpot, and use features like Smart Cart and Expected Inventory to fill your cart based on weekly usage or pars.

Learn more about ordering

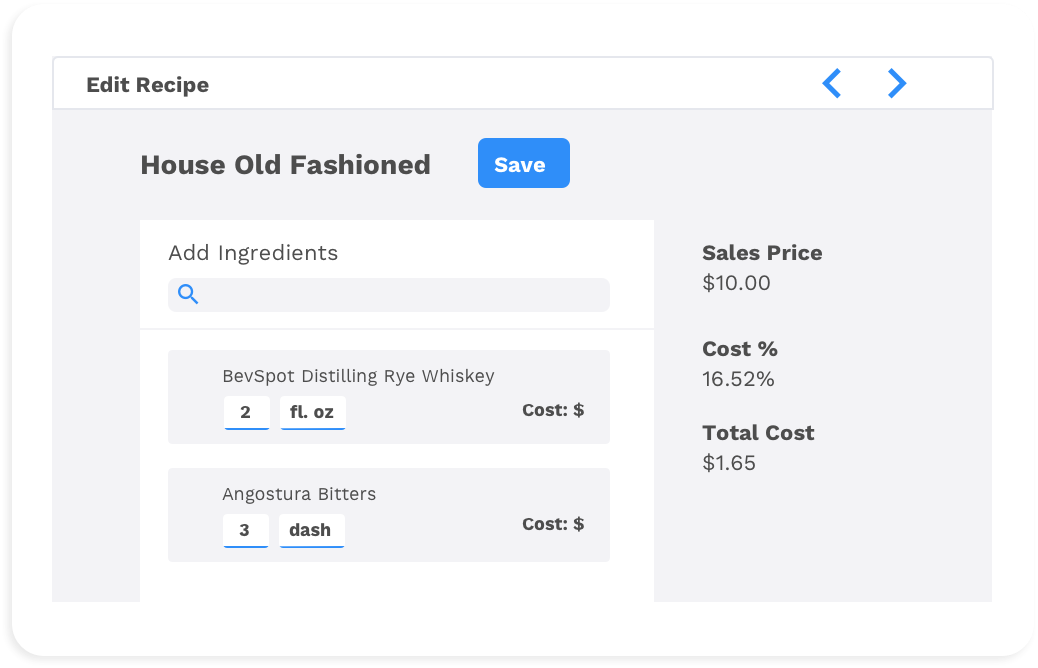

Master your cost percentage with recipes and menu items.

Easily create and manage recipes, track cost percentage and ingredient price changes, then swap ingredients in and out of recipes to create the tastiest and most profitable menu for your business.

Learn more about recipe costing

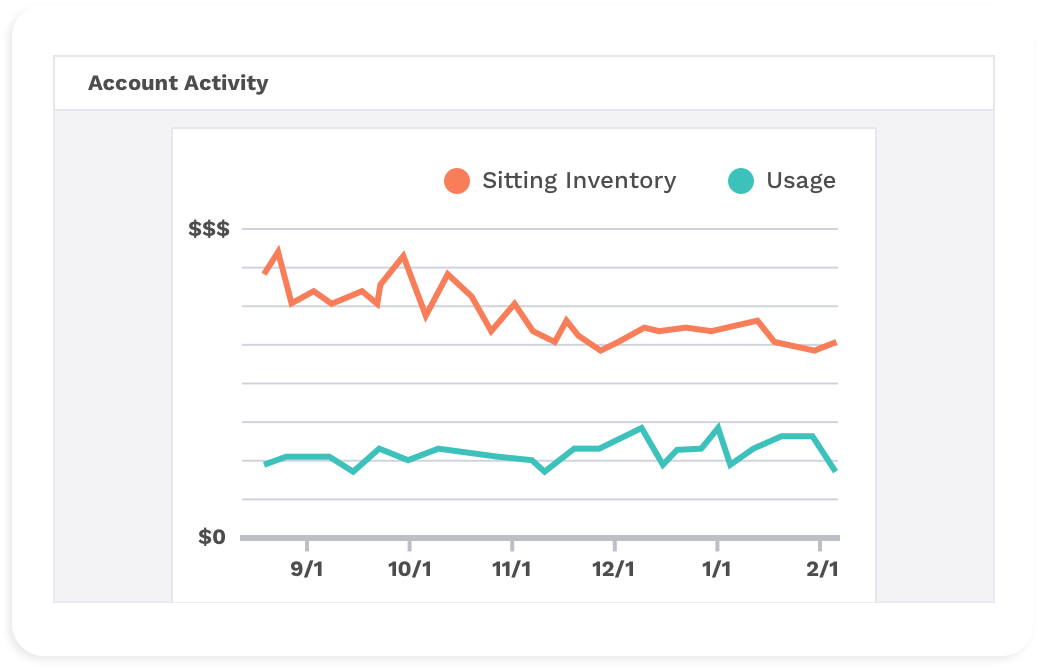

Get fast and insightful analytics to help you manage your business.

Our reports include helpful charts and graphs making it easy to track and compare sitting inventory and COGS. Our price tracker shows price fluctuations overtime and helps you to identify opportunities to save.

Learn more about reporting

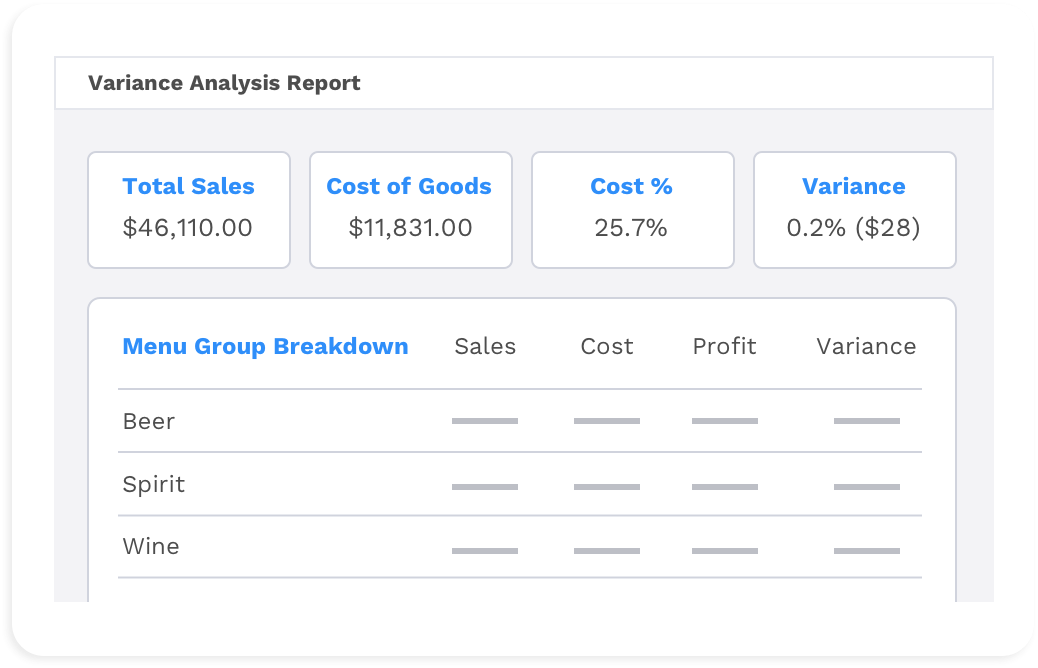

Monitor item-level variance and menu profitability.

BevSpot connects sales and inventory to your POS system for a complete picture of what you’re selling.

Learn more about salesThis system is so insanely easy. I’ve worked with a bunch of other systems and nothing has been this easy before.

- John Galeno, GM

Tonno - Wakefield Resurrection

It was really easy to contact the onboarding team whenever we needed to. The training calls really helped to get us up to speed.

- Ryan Vermillion, Asst. Food & Beverage Manager

Marriott at West Des Moines

It’s easy to use. Inventory is a breeze. Ordering is super easy. I love it!

- Frank Kraemer

Hilton Garden Inn

Very user friendly with a lot of options to help, along with the BevSpot team! BevSpot has been huge for myself during our opening!